S.M.A.R.T Financial Planning

SMART Financial Planning: A Comprehensive Guide

In today’s dynamic financial landscape, effective planning is essential for achieving long-term goals. Many individuals find themselves caught in the whirlwind of immediate needs, often neglecting to establish a clear financial strategy. However, utilising the S.M.A.R.T framework can significantly enhance your financial planning efforts, allowing you to set and achieve your financial objectives with clarity and purpose.

Understanding S.M.A.R.T Financial Goals

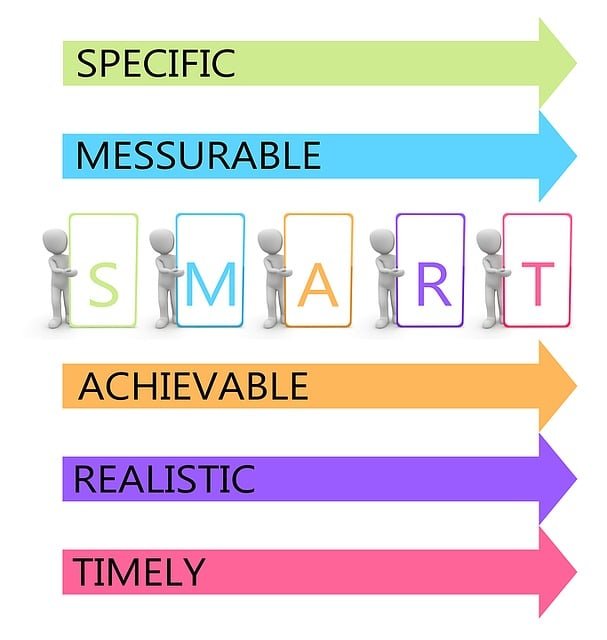

The S.M.A.R.T acronym stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This framework serves as a powerful tool for creating structured financial goals that facilitate a clear path to success. Let’s delve into each component to understand how they contribute to effective financial planning.

When setting financial goals, specificity is paramount. A vague goal such as “I want to save money” lacks direction. Instead, articulate precisely what you intend to achieve. For example, “I aim to save £10,000 for a home deposit within the next two years” provides a clear target.

Key Considerations:

- Define the exact amount you wish to save or invest.

- Identify the purpose behind your financial goal.

- Specify the resources you will allocate towards achieving this goal.

Measurable

Measurability allows you to track your progress and stay motivated. Establish quantifiable indicators that enable you to assess how close you are to achieving your goal. For instance, if your objective is to save £10,000, determine how much you need to set aside each month to reach that figure.

Action Steps:

- Create a detailed savings plan outlining monthly contributions.

- Use financial tools or apps to monitor your progress.

- Adjust your plan as necessary to stay on track.

Achievable

While it’s essential to set ambitious goals, they must also be realistic and attainable. Consider your current financial situation and resources. Aiming to save £100,000 in a year may not be feasible if your income does not support it. Instead, break down your goal into manageable steps.

Tips for Achievability:

- Assess your income and expenses to determine a realistic savings rate.

- Consider potential obstacles and devise strategies to overcome them.

- Set incremental milestones to celebrate small victories along the way.

Relevant

Your financial goals should align with your broader life objectives. They must resonate with your personal values and aspirations. For instance, if you are passionate about travel, saving for a holiday can be a relevant goal within your financial plan.

Reflect on the Following:

- How does this goal fit into your overall life plan?

- Will achieving this goal positively impact other areas of your life?

- Are there any conflicting priorities that need consideration?

Time-bound

Establishing a timeline for your goals instills a sense of urgency and accountability. Without a deadline, your goals may remain mere wishes. Set a clear timeframe for achieving your financial objectives.

Strategies for Time Management:

- Break your goal into smaller, time-sensitive tasks.

- Set deadlines for each milestone to maintain momentum.

- Regularly review your progress to ensure you are on schedule.

Crafting Your S.M.A.R.T Financial Goals

Now that we understand the S.M.A.R.T framework, let’s explore how to craft effective financial goals using this methodology.

Example 1: Saving for a Home Deposit

- Specific: Save £20,000 for a house deposit.

- Measurable: Save £500 each month for 40 months.

- Achievable: Review your budget to ensure this amount is realistic based on your income.

- Relevant: Owning a home aligns with your long-term aspiration of financial independence.

- Time-bound: Aim to achieve this goal within three years.

Example 2: Retirement Savings

- Specific: Accumulate £250,000 in a retirement fund.

- Measurable: Contribute £1,000 monthly to a retirement account.

- Achievable: Assess your current savings and investment strategies to ensure this is feasible.

- Relevant: This goal is crucial for ensuring a comfortable retirement lifestyle.

- Time-bound: Set a deadline of 20 years to reach this target.

Example 3: Emergency Fund

- Specific: Build an emergency fund of £15,000.

- Measurable: Save £300 monthly for 50 months.

- Achievable: Evaluate your monthly expenses to determine if this saving rate is attainable.

- Relevant: An emergency fund is vital for financial security and peace of mind.

- Time-bound: Complete this goal within four years.

Strategies for Achieving Your S.M.A.R.T Goals

Setting S.M.A.R.T goals is just the beginning; actualising them requires commitment and strategic planning. Here are some effective strategies to help you stay on track.

- Create a Financial Plan

A comprehensive financial plan acts as a roadmap for achieving your S.M.A.R.T goals. Outline your income, expenses, savings, and investment strategies. Regularly review and adjust your plan to reflect changes in your financial situation.

- Automate Your Savings

Automating your savings can simplify the process and ensure consistency. Set up automatic transfers from your checking account to your savings or investment accounts. This approach helps you prioritise saving without the temptation to spend.

- Monitor Your Progress

Regularly assess your progress towards your goals. Use budgeting apps or spreadsheets to track your savings and investments. This practice will help you identify any discrepancies and make necessary adjustments.

- Stay Educated

Financial literacy is crucial for effective planning. Continuously educate yourself about personal finance, investment strategies, and market trends. This knowledge will empower you to make informed decisions and adapt your strategies as needed.

- Seek Professional Advice

If you feel overwhelmed or unsure about your financial planning, consider consulting a financial advisor. A professional can provide personalised guidance and help you navigate complex financial decisions.

Overcoming Challenges in Financial Planning

While pursuing your S.M.A.R.T goals, you may encounter various challenges. Being prepared to face these obstacles can enhance your resilience and keep you on track.

- Unexpected Expenses

Life is unpredictable, and unforeseen expenses can derail your financial plans. Establishing an emergency fund can provide a safety net, allowing you to manage unexpected costs without compromising your savings goals.

- Market Volatility

Investment markets can be volatile, leading to fluctuations in your portfolio value. Stay focused on your long-term goals and avoid making impulsive decisions based on short-term market trends. Diversifying your investments can also mitigate risks.

- Lack of Motivation

Staying motivated can be challenging, especially when progress seems slow. Celebrate small milestones to maintain enthusiasm and remind yourself of the bigger picture. Engaging with a community of like-minded individuals can also provide encouragement.

The Importance of Flexibility in Financial Planning

While it’s essential to have a structured plan, flexibility is equally important. Life circumstances can change, and your financial goals may need to be adjusted accordingly. Regularly review your goals and be willing to adapt your strategies as needed.

- Reassessing Goals

As you progress, periodically reassess your financial goals. Are they still relevant? Have your circumstances changed? Adjusting your goals ensures they remain aligned with your current situation and aspirations.

- Adapting to Life Changes

Major life events such as marriage, parenthood, or job changes can significantly impact your financial planning. Be proactive in evaluating how these changes affect your goals and make necessary adjustments to your financial plan.

Conclusion

Effective financial planning is a journey that requires dedication, organisation, and a clear strategy. By adopting the S.M.A.R.T framework, you can set achievable financial goals that align with your long-term aspirations. Remember to remain flexible, monitor your progress, and seek support when needed. With the right mindset and approach, you can navigate the path to financial security and independence with confidence.

This article serves as a comprehensive guide to S.M.A.R.T financial planning. By following the outlined strategies and principles, you can embark on a successful financial journey, ultimately leading to a more secure and fulfilling future.

Thank you for visiting our S.M.A.R.T Financial Planning Page

Please click the Link below to go to that page:

Home Finances Relationships Health Personal Development Spiritual Blog